This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Have you ever wondered why it’s a good idea to put your money in a bank? Here are a few reasons:

- Safety. The government insures deposit accounts at valid banks, along with credit unions. This insurance protects at least $250,000 per person, per bank. Look for the FDIC and NCUA seals.

- Convenience. If you get a debit card, you can use it like cash almost everywhere. Plus, if your debit card gets lost or stolen, you can cancel it and get a new one.

- Interest. With savings accounts, your money earns money—just by staying in the account!

Terms to know

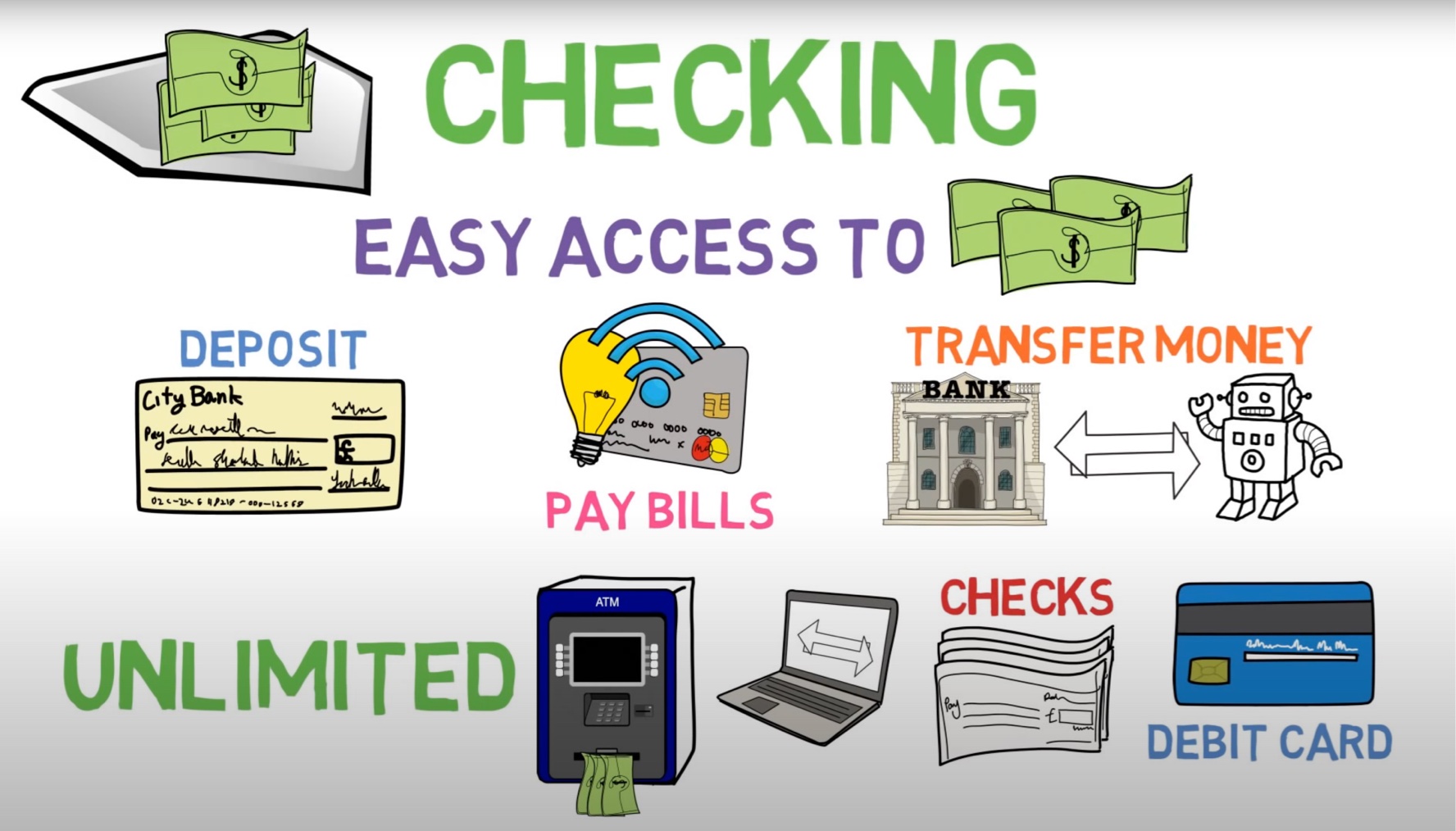

Checking Account: A basic checking account can save you lots of money on check cashing fees. It can also give you secure, easy access to your money whenever you need it.

Savings Account: A savings account lets you safely set aside money for later. And savings accounts earn interest, which basically means your money is making money.

Budgeting: A budget is a plan for how you want to spend your money. Making a plan can help you pay your bills on time. It can also help you save money for things you want or need. Once you have a budget, you can use that plan to track your spending and stay on target..

Get Answers:

Checking accounts are the safest way to store and access your money. With ATMs and debit cards, your money is never far away. And up to at least $250,000 per person, per bank is insured by the government. Bank accounts make paying bills much easier, thanks to online bill pay and automatic debits. They can even make getting paid by your job much easier, thanks to direct deposit.

Unlike checking accounts, savings accounts are not meant to be accessed very often. They are meant to store extra money and help you keep it safe for a rainy day or large purchases. Savings account also earn you interest just for keeping your money in the bank. Like checking accounts, up to at least $250,000 per person, per bank is insured by the government.

There are multiple ways to make use of the money you have in your checking account. As the name implies, you can write a check in the amount you wish to spend. More often these days, though, bankers use debit cards to make purchases. You can also use your debit card at ATMs to pull cash out. Finally, thanks to online banking and mobile cash apps like PayPal, you can pay bills or send money to friends and family electronically.

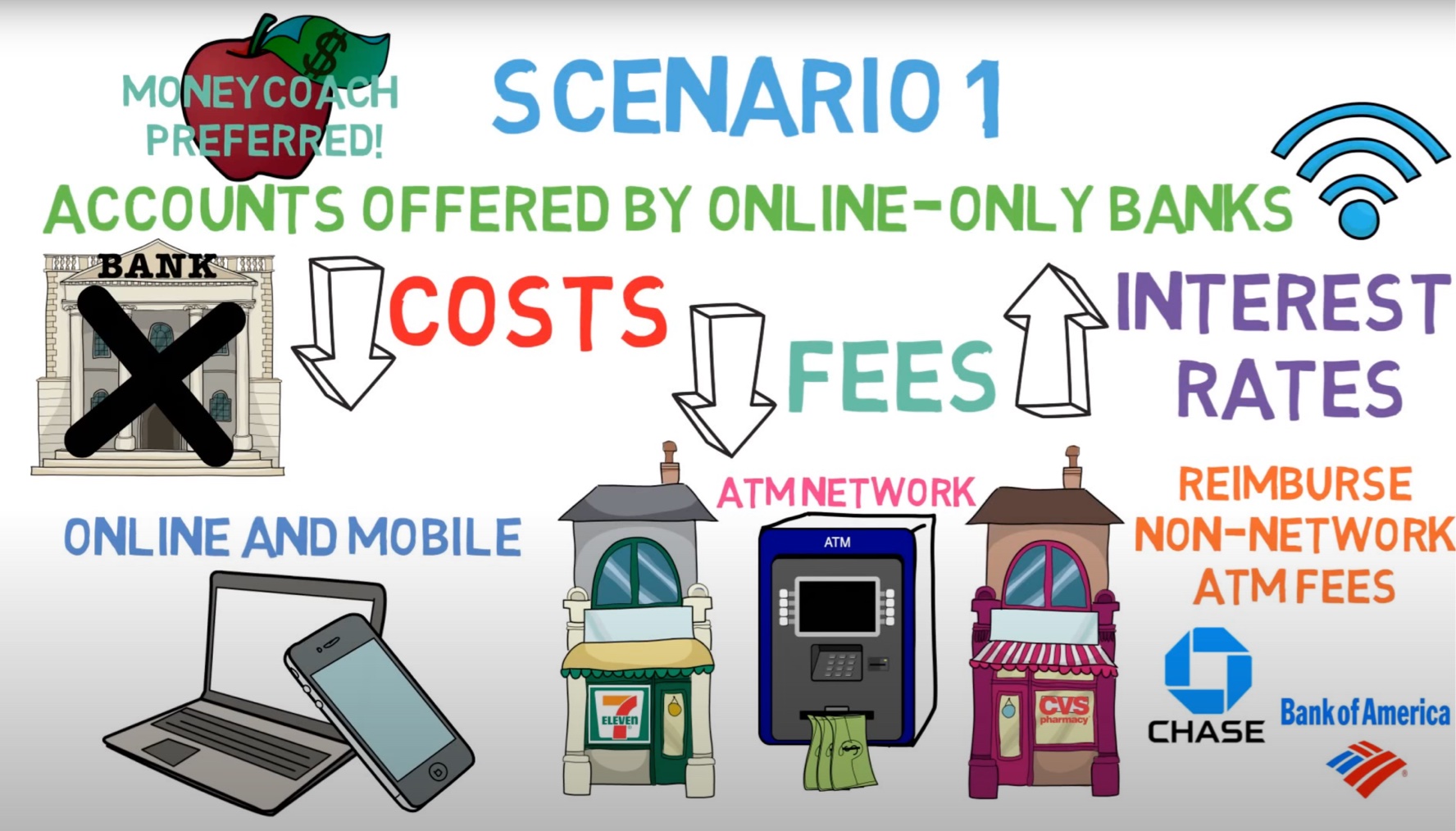

Choosing a bank that is right for you depends on a few things. But generally speaking, look for accounts that do not charge you lots of fees or require you to keep a certain amount of money in the account at all times. Look for accounts that offer the best interest yields (returns) for the money you keep in your account. Even some checking accounts can earn you a little bit of interest.

There are many banks that do not have physical locations. These banks often offer low-fee or no-fee accounts and have the best interest yields. You can also look for local credit unions. They offer the same services as banks, but are nonprofits and owned by their members. They often offer much better rates on loans and better interest yields on your accounts. More about credit unions

Check-cashing stores are a bad way to access your money. When you take your paycheck (or any other check) to a check-cashing store, they will take out 5-10% of your money in fees. It’s much better to get your job to direct deposit your money into your checking account. It’s free and won’t require a trip to the check cashier.

Many banks, especially online-only banks, offer checking accounts that cost you nothing to use. There are no requirements on how much money you have to have in the account, and they don’t charge monthly fees—or fees if you accidentally write a check for more money than you had in your account. Other banks waive their monthly fees if you have your paycheck direct deposited into the account. Making sure you always know how much money you have available in your account is the best way to make sure you do not get any surprise fees.

Since a budget tracks both what you earn (income) and what you spend (expenses), the best way to get started is to identify how much you earn every month. That amount will be the total you have for expenses (and savings). Once you know that, you can categorize what you spend and allot portions of your income to each spending category.

You can make a very detailed plan or a simple one. Watch Budgeting Basics – Types of Budgets to learn about the different types of budgeting plans you can try. NerdWallet also has a great description of budgeting systems (types) as well as tools to get you started.

Creating a budget is great, but it doesn’t do a lot of good if you don’t track your spending to see how you’re doing. Apps like EveryDollar make tracking easier, but it’s really about getting in the habit. If you find that tracking your spending is too much of a hassle, maybe you need a simpler budget plan. A 50/30/20 plan is probably the simplest plan you can make, and it requires less detailed tracking.

That depends on how detailed you want to get with your budget. You can keep it basic and only track needs (like bills), wants (fun stuff), and savings (money to set aside), or plan for lots of specific categories like rent, gas, internet, food, dining out, entertainment, etc. It’s important to track your spending against your budget, so only make it as complicated as you feel you can track.

A common and simple budget plan system is the 50/30/20 plan. This system only has three categories: 50% for needs (like bills), 30% for wants (fun stuff), and 20% for savings (money to set aside). This simple system accounts for all of your spending, but doesn’t require you track so many specific categories.

The first step to any budget plan is knowing how much money you have to work with, your income. Your income is made up of any money you receive (usually monthly) such as from paychecks, allowance, tips, etc. When making a budget, it’s important to only calculate your income after taxes have been taken out. On your paycheck, this is usually called “net pay.”